Quick Summary:

Bitcoin has outperformed other cryptocurrencies since mid-February and its market dominance surged from 44% to nearly 50% by the end of March, possibly due to stress with US banks.

Bitcoin's correlation with US stock returns dropped from 70% in May 2022 to 25% in late March, but its outperformance could also be due to regulatory concerns with non-Bitcoin cryptos and liquidity issues with stablecoins.

Crypto investors remain alert to economic data updates and regulatory developments, and signs of exuberance have started to creep back.

Bitcoin is making a move

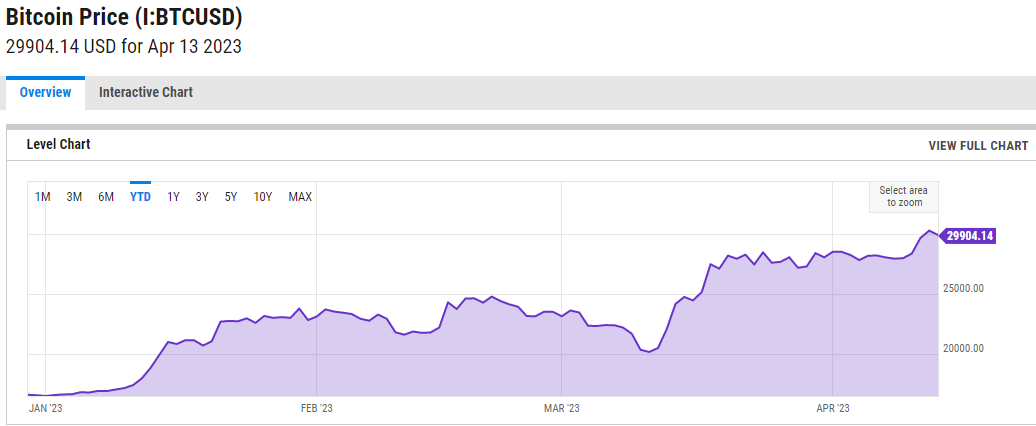

It looks like Bitcoin is having a blast outperforming its digital siblings since mid-February. The party really kicked off in early March when the US banking system decided to throw a tantrum. This led to Bitcoin's market dominance surging from 44% at the end of February to just shy of 50% by the end of March. At the time of writing, the original crypto is up c. 80% for 2023 so far.

Investors would be right to ask, "why the sudden surge?" Turns out, the stress with US banks (and with Credit Suisse) reminded everyone that Bitcoin's "store-of-value" properties might have some credibility since it exists outside the traditional financial system. In other words, it's become the cool kid that doesn't play by the rules if enough people think there’s even a remote possibility of commercial bank instability.

We’ve also seen some other characteristics that might interest people with more traditional investments. Bitcoin's correlation to US stock returns (using the S&P 500 as a proxy) plunged from a peak of 70% in May 2022 to a mere 25% in late March. This may have alerted some investors to the potential for adding crypto as a source of diversification rather than return. However, with such a short track record, the jury is still out on the likely correlation between crypto and other asset classes. The recent moves suggest crypto might perform better during a period of financial armageddon.

But let's not give Bitcoin too much credit. Its outperformance could also be due to investors getting cold feet about the regulatory status of non-Bitcoin cryptos and some liquidity hiccups with some so-called “stablecoins”. This may have prompted flows from other crypto assets into Bitcoin in the same way the US Dollar can benefit relative to more volatile currencies during periods of market stress.

What about the economy?

On the macro front, there's no shortage of economic data to keep us on our toes and crypto investors remain on high alert to economic data updates from the US and further afield, alongside anything with a regulatory angle. There’s even been some talk that China has started to soften its typically aggressive stance to the blockchain sector.

We’ve also seen tighter (more restrictive) US financial conditions as flows into money market funds accelerated post-banking turmoil (SVB, Silvergate, etc), pushing total net assets above a staggering $5 Trillion.

Can we be optimistic again?

It does seem crypto folk are feeling a bit more optimistic right now and signs of exuberance have started to creep back. A new cryptocurrency, CryptoGPT, recently reached a market valuation of over £200m despite the fact no one knows much about the project, the founders or how the token might be useful! However, with the Fed nearing the end of its hiking cycle, long-duration assets such as tech stocks and crypto might welcome developments in markets over the second half of 2023 (even if interest rate cuts aren't on the cards just yet).

Finally, it’s worth watching out for news of Ethereum's upcoming Shanghai Fork which was released yesterday (April 12). It’s the next chapter in the shift of the 2nd largest crypto, Ethereum, from an energy-intensive proof-of-work mechanism to a much more ‘eco-friendly’ proof-of-stake process.

Conclusion:

Overall, the crypto and macro landscape remains fluid.

Investors will be watching for news on Ethereum's upcoming Shanghai Fork and potential developments in markets in the second half of 2023 but feel much more confident today than they did a few months ago.

Seems as though the crypto and macro landscape is never short of excitement!

Disclaimer

None of the above is financial advice

The opinions reflected are my own personal views

Second guessing the crypto market is impossible but we can still try to understand the rules of the game

Feedback is always welcome